Tech companies like to throw the word around, but what does Agentic AI really do?

In a private interview with Jeff Roy (CEO Excalibur Insurance Group), Charles Dugas (EVP of Koïos Intelligence) dive into autonomous AI systems that can complete tasks with limited supervision.

Picture this: with agentic workflows, your AI isn't just sitting around waiting for you to input a prompt but proactively scanning renewals, comparing rates, talking to clients, and even scheduling meetings. This is the world of Agentic AI, where your software doesn't just assist, it acts.

This blog post breaks down the reasons why Agentic AI isn't just another shiny toy touted by tech start-ups—it's a whole new operating system for the insurance channels.

Traditional AI vs. Agentic AI: What's the difference?

"For instance, with traditional AI, if you want an analysis you need to drop some data in there and then say, 'Please analyze the data.' I find that's very useful, but I have to prompt it do it. Whereas an agentic AI is proactive, so it goes out and does things ahead of time." – Jeff Roy

While traditional AI waits for a user's instructions, Agentic AI takes the lead. The only programming needed is in the initial agent development, where you can determine its scope, permissions, and role within the workflow. From there, the AI works like any other member of your team. It's the difference between an intelligent chatbot and a autonomous agent that reads your inbox, understands what's urgent, and solves the problem before you can think about it.

Jeff points out that in the insurance world, seamless connection between brokers, companies, and vendors is crucial. Agentic AI systems can be the go-between these key players, creating a more fluid workflow that reduces downtime, improves sales, and keeps tasks in motion.

Practical Applications: How Agentic AI Reinvents Renewals

Making meeting notes is something that every industry does, not a task specific to insurance. So what's an example of an insurance process that Agentic AI can handle? Renewals.

Waiting on information, especially during busy seasons, can slow down operations.

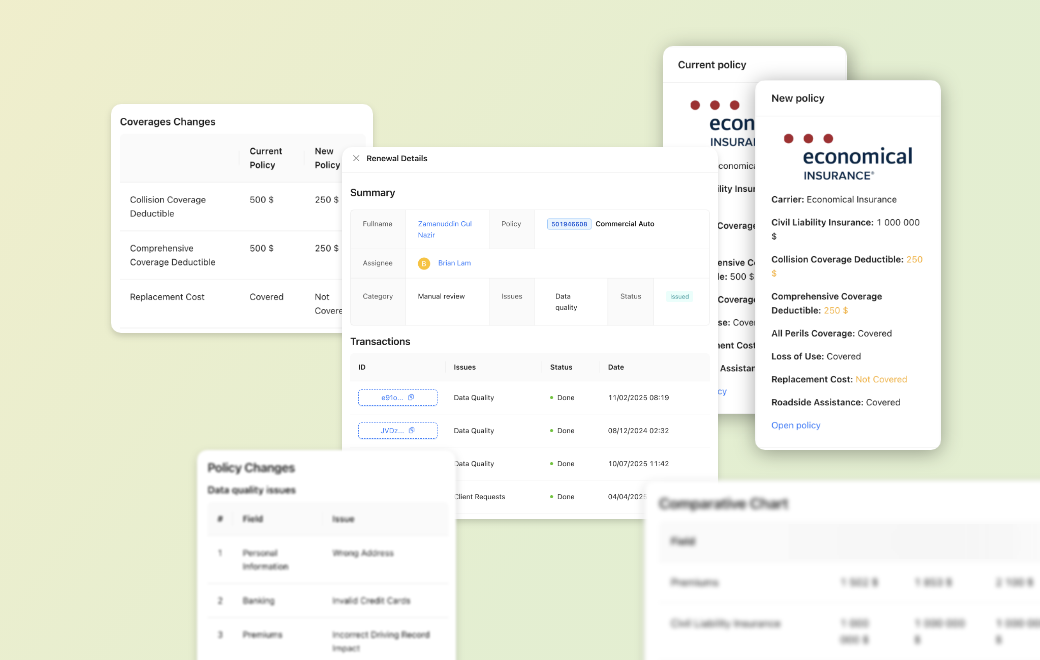

"Currently, the process kicks off by emailing the client. Then we run comparisons, check coverages and so on. With Agentic AI, all of that can be automated. They are smart enough to go out, get the rates, do all the coverage checking, and bring it back in. They'll also look at the dec pages using OCR and then kind of look for coverage gaps." – Jeff Roy

Several companies, including Koïos, are pioneering this technology to create what Jeff Roy calls "Super Brokers and Agents": "I'm a big fan of 'AI + human = Super Broker'," says Jeff Roy. "A lot of the ground work can be done by the Agentic AI but we have to insert a human into the loop."

Such is the case for almost all insurance products on the market; the final judgment call still remains with the human broker or agent. That's not going anywhere.

Current Roadblocks in the Agentic Landscape: Awareness and APIs

"AI solutions are still early in the insurance game, and a big part of it is that agents and brokers aren't aware of it. They're still doing things traditionally. They're just hearing about AI. They're just playing around with ChatGPT. They're using the simpler tools." – Jeff Roy

This is in part due to the fact that brokers and agents face a storm of questions: Are AI tools any good? Do they integrate? If they make a mistake, who's to blame? Jeff Roy recalls that insurance businesses have banked on shiny objects in the past, only for those products to fail. He notes that in 2016–2020, the insurance world was full of 'cool' tech that didn't move the needle. Now businesses have learned the hard way. Now, they want to see the results up front. They won't buy a robot because it looks good on paper.

Secondly, Agentic AI needs all the same permissions to insurance systems that typical employees have. It needs to connect into CRMs, BMSs, Email systems, and more. If there's no API there, then it needs the password. As it stands currently, APIs just aren't as available or as open as insurance professionals would like, and new companies don't have the depth to work out these connections in time. But, developments in the AI landscape are quickly gaining ground.

"In the past you had 15 or 20 years to figure out how to go digital. With AI automation, you've only got 10 or 15 minutes to figure out." – Jeff Roy

The pace of AI adoption in insurance is nothing like the slow digital transitions of the past. While brokers once had years to adjust to new technology, AI moves in minutes, and those who hesitate risk falling behind. Tech companies are already turning Agentic AI into a standard, everyday tool, making it essential for agents and brokers to get ahead, understand these innovations, and build expert knowledge before the competition does.

Building Trust with AI Tools

While brokers and agents struggle with awareness, the ones that are aware struggle with trust. If an Agentic AI tool can re-quote and compare policies, send emails and call clients, does it need to pass the broker's license exam to start selling policies on its own?

"Trust is earned over time. You can't set the AI and let it go wild (no more than you would a new employee), because that's when problems happen. We have to make sure the guardrails are in place. You just can't blindly say that everything's correct and pull the human out of it. – Jeff Roy

Generative AI systems that operate freely are prone to hallucinations, they are not always compliant, and consumers are the ones paying the price. Jeff Roy stresses that the customer must be protected at all times, and regulators are waking up to this reality even if they don't understand it. Even if the AI acts on its own, current regulations dictate that the broker is always accountable. This fact can scare brokers away from adopting the technology, since it can feel as if the AI is actually limiting work operations.

However, Jeff Roy affirms that eight years after the birth of public AI, models are growing every day. "There's an AI arms race right now," he says, "everybody's trying to harness the AI wins right now."

The Super Broker Future

Fast forward five years: the AI does the heavy lifting, and the broker becomes a "Super Broker." Less keystrokes, more conversations. Fewer spreadsheets, more relationships.

"Brokers who use AI will replace brokers who don't. I said it in 2018. I still mean it." – Jeff Roy

Want to Start Adopting AI?

Here's how to find the right fit.

Shop Around

Don't settle for the first shiny opportunity you see. Make sure you're contacting reputable vendors with well-developed solutions.

Is it easy to implement? Is it going to give me a return on my investment? What is my ROI? Will it make my people more productive? Can they do more in an hour than they could do without the technology and at the end of the day? Is everybody more efficient? – Jeff Roy

Make Sure Your Team Likes Your Tech

Even if the tool saves time or money, does it create stress?

The industry right now, there's so many changes. There's a lot of broken processes, and at the end of the day, it comes down to humans that have to feel the brunt of the pain. We need to have AI take that away, or make it easier and make this business better, and arm our people with stuff right on the spot.

Final Thoughts

As Jeff Roy likes to say, AI isn't here to steal your job. It's here to take your repetitive tasks and give you time to be what you're best at—a human.

So when you're looking for an AI solution, hold your tools to the same standards that you hold your teammates to. Your Agentic AI will need regular check-ups, training, and database access. The future's not fully automated—it's agentic, and you're still in charge.

About Koïos Intelligence

Founded in 2017, Koïos Intelligence's mission is to empower the insurance and financial industry with the next generation of intelligent and customized systems that are supported by Artificial Intelligence, statistics and operational research. Combining the knowledge of our lead experts in Insurance, Finance and Artificial Intelligence, Koïos is developing new technologies that redefine the interactions between insurers, brokers and customers.