"We know AI is important… but how exactly does it fit into our workflow?"

That's the question we hear from brokers every day. AI sounds promising, but for many brokerages, the real-world application still feels abstract.

AI in the insurance industry is more than just quote automation, which web forms attempt to streamline. In fact, AI has made significant strides in recent years, especially within finance and insurance, where its deployment has considerably transformed how we view traditional practices.

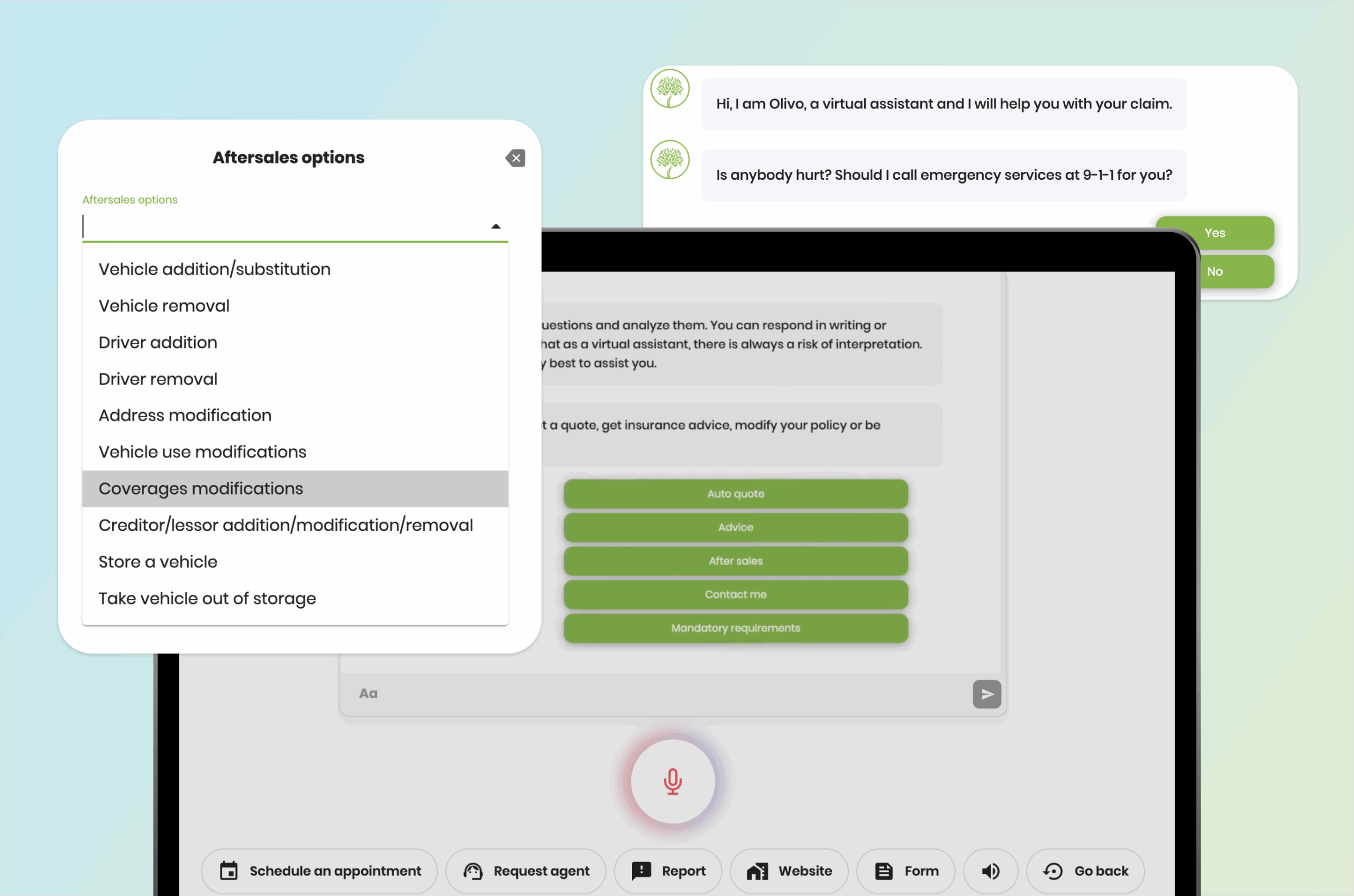

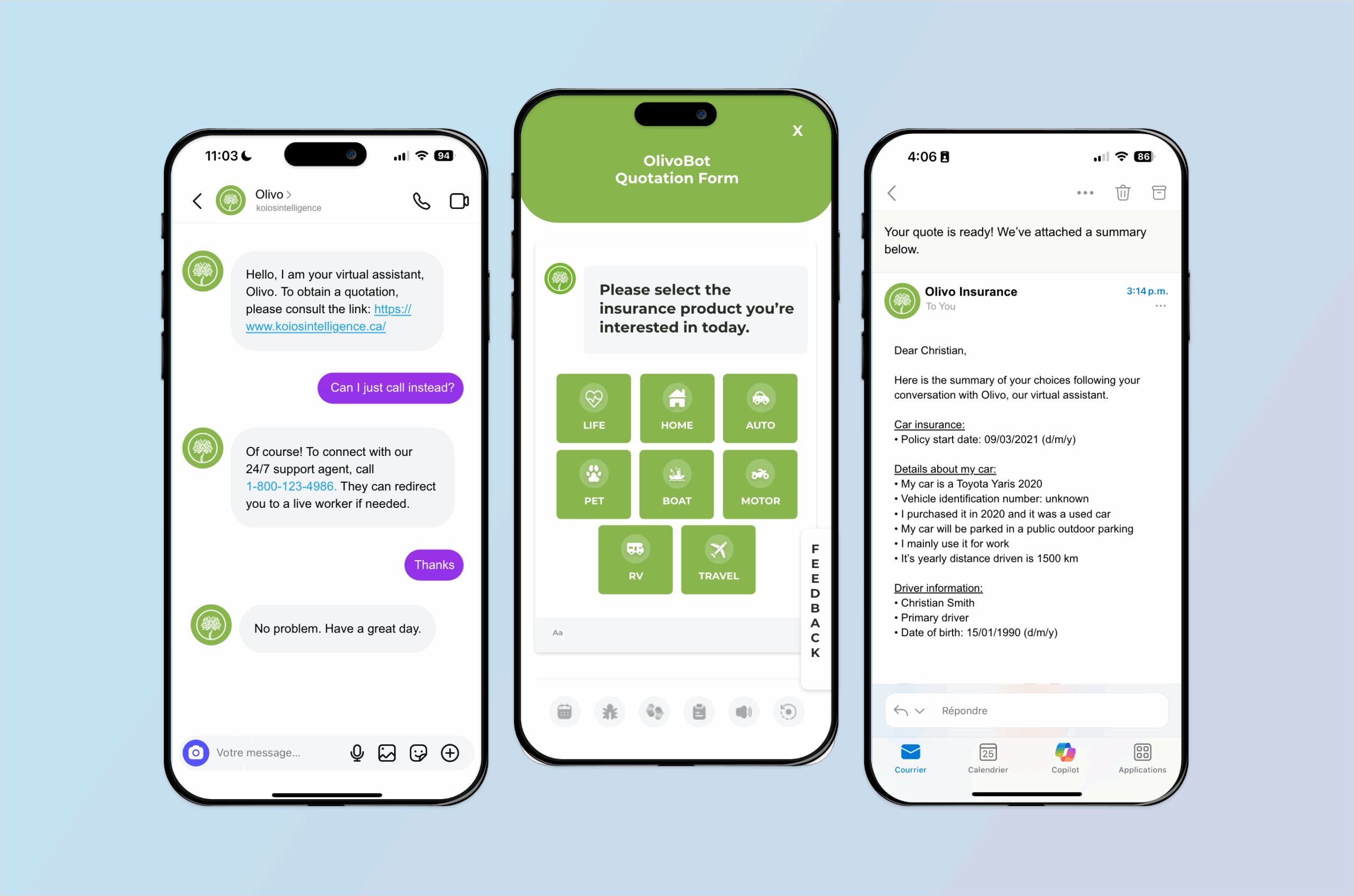

If you're an insurance professional, it's essential to know the different ways you can leverage the power of AI in everyday processes. Koïos Intelligence, is spearheading the movement to implement groundbreaking applications of AI with a cloud platform Olivo, to support the transformation of conventional insurance workflows.What does the application of new AI technology look like in insurance? Let's explore some of the more compelling use cases driving the shift.

10 Use Cases for AI in Insurance

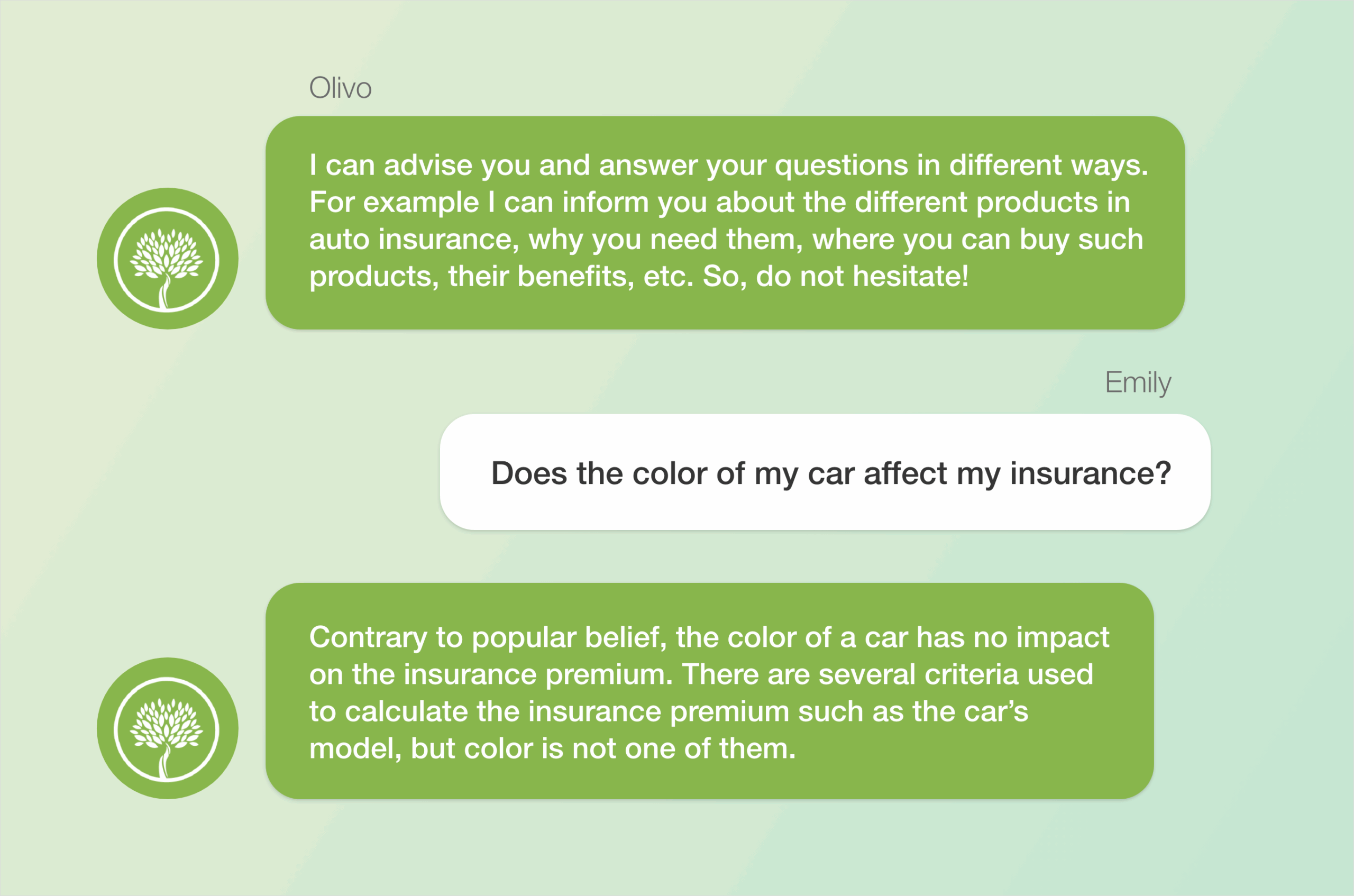

AI must be as beneficial in its deployment as it is compliant. AI virtual assistants trained on private Large Language Models, as opposed to open models such as ChatGPT and Claude, are fine tuned to provide accurate and contextualized answers to your specialized domain.

Private LLMs are a better fit for industries like insurance, where sensitive data and compliance matter. They offer greater control, customization, and protection—keeping data secure and within organizational boundaries.

As we shift our sights towards the future, we can reflect back on how far we've come. The move from physical brokerages and agencies to digitization took decades, but AI is rapidly developing and may soon become the new normal. Picture this: your AI isn't just waiting for prompts—it's out there doing real work. Scanning renewals, comparing rates, collecting data from clients, scheduling meetings. Welcome to Agentic AI—where software acts, not just assists.

Don't be left behind. The future of insurance is in AI, and your brokerage or agency can get ahead of the competition by getting on at the nearest station. Reach out to Koïos to book a free demo today.

About Koïos Intelligence

Founded in 2017, Koïos Intelligence's mission is to empower the insurance and financial industry with the next generation of intelligent and customized systems that are supported by Artificial Intelligence, statistics and operational research. Combining the knowledge of our lead experts in Insurance, Finance and Artificial Intelligence, Koïos is developing new technologies that redefine the interactions between insurers, brokers and customers.