Making Your Insurance Business Work Better

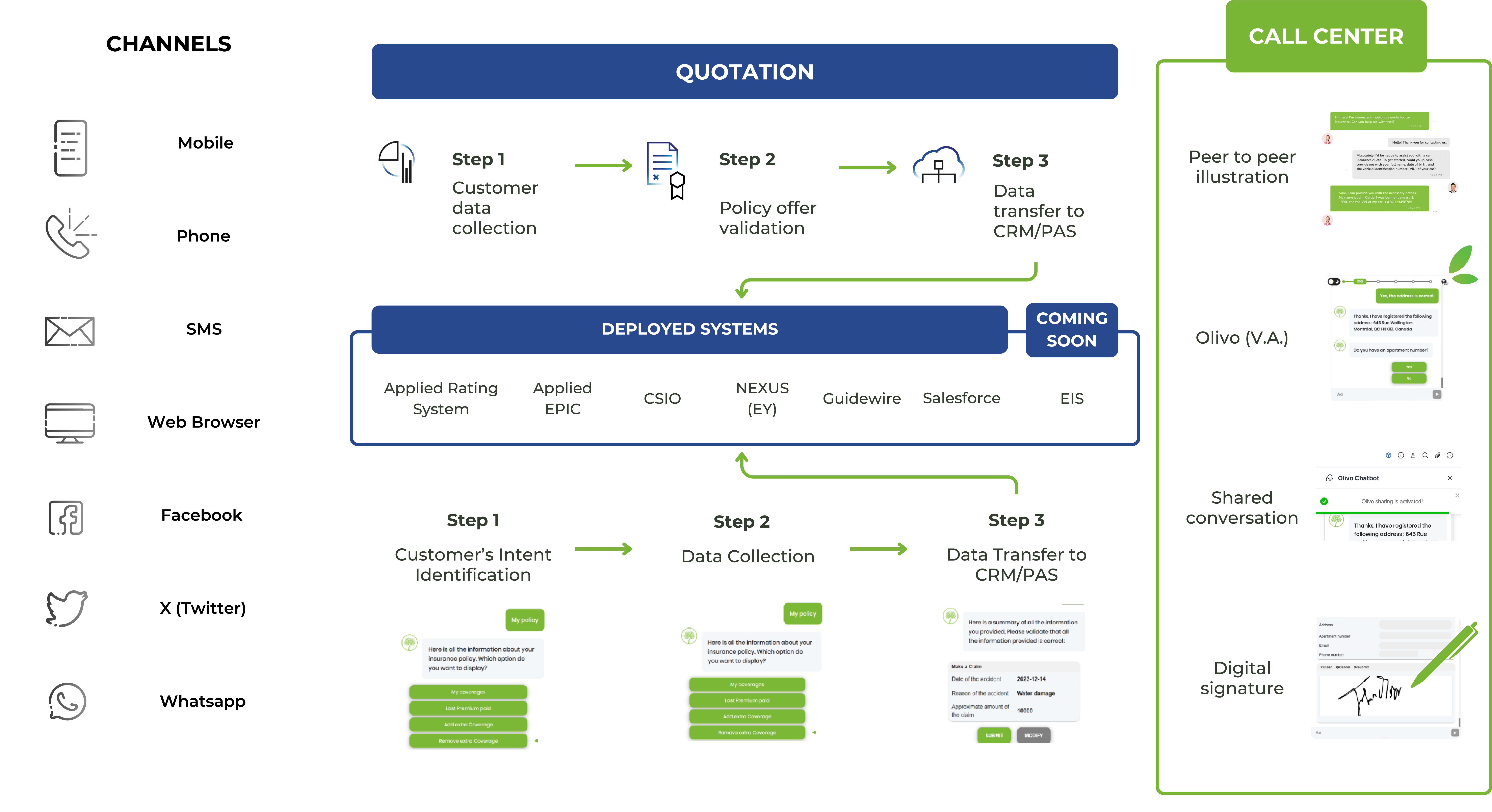

THE CLIENT PROCESS

Our Products

OlivoBot

OlivoBot

conversational ai agent

Transform the insurance experience with OlivoBot — allowing easy navigation of the quotation processes through voice interactions with Olivo, and at any point, seamlessly transition to a Form view for rapid completion. OlivoBot extends its functionality to empower clients, allowing them to view and update information on existing contracts and reach out to agents at their convenience for personalized support.

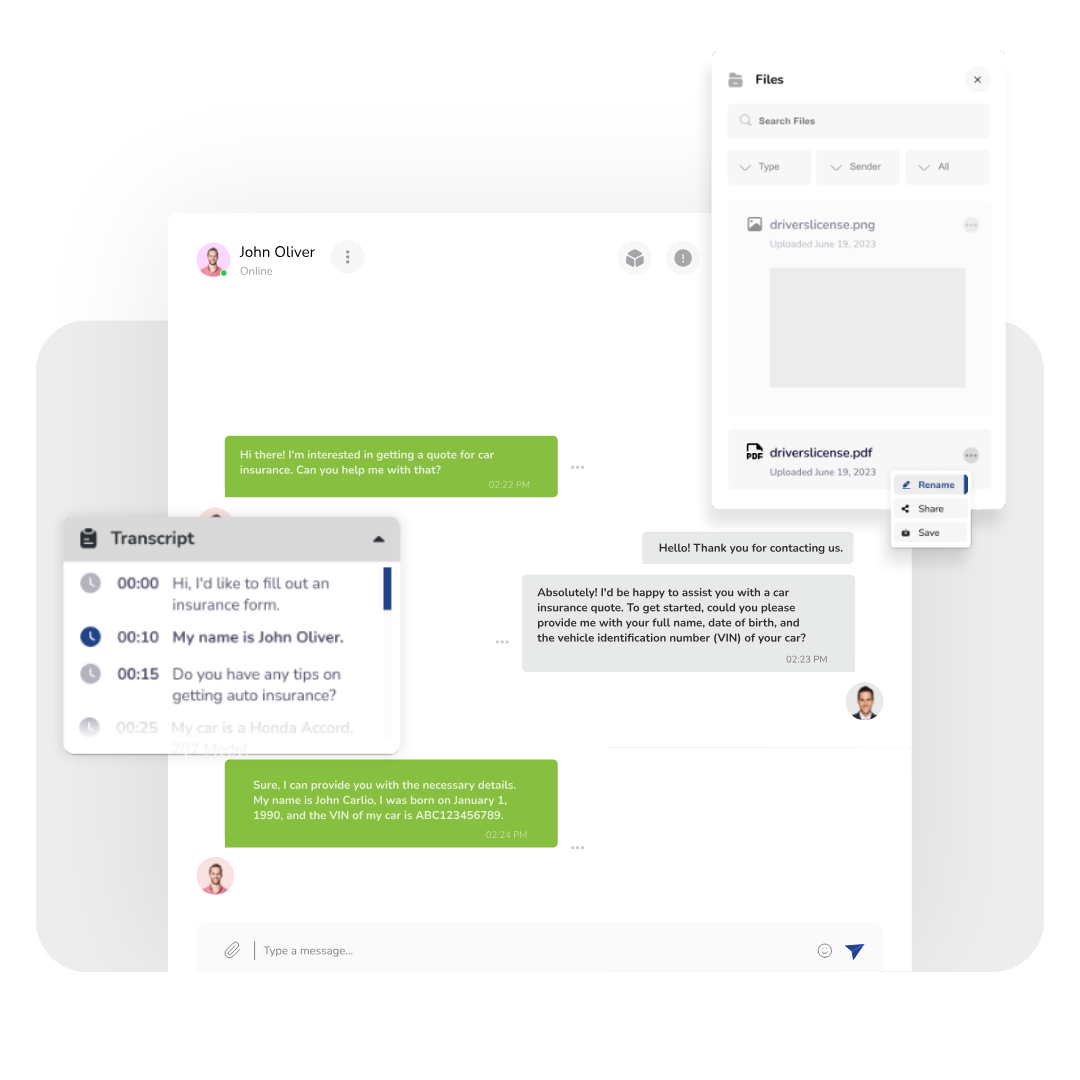

OlivoLive

OlivoLive

communication platform

Elevate customer engagement with OlivoLive — integrating conversational AI into our live chat platform. This innovative feature ensures a seamless handover from AI to human agents, facilitating comprehensive interactions through chat, video conferencing, and attachment sharing. The human agents can then efficiently finalize transactions, verify important documents, and access a version of the conversational AI for additional support when needed.

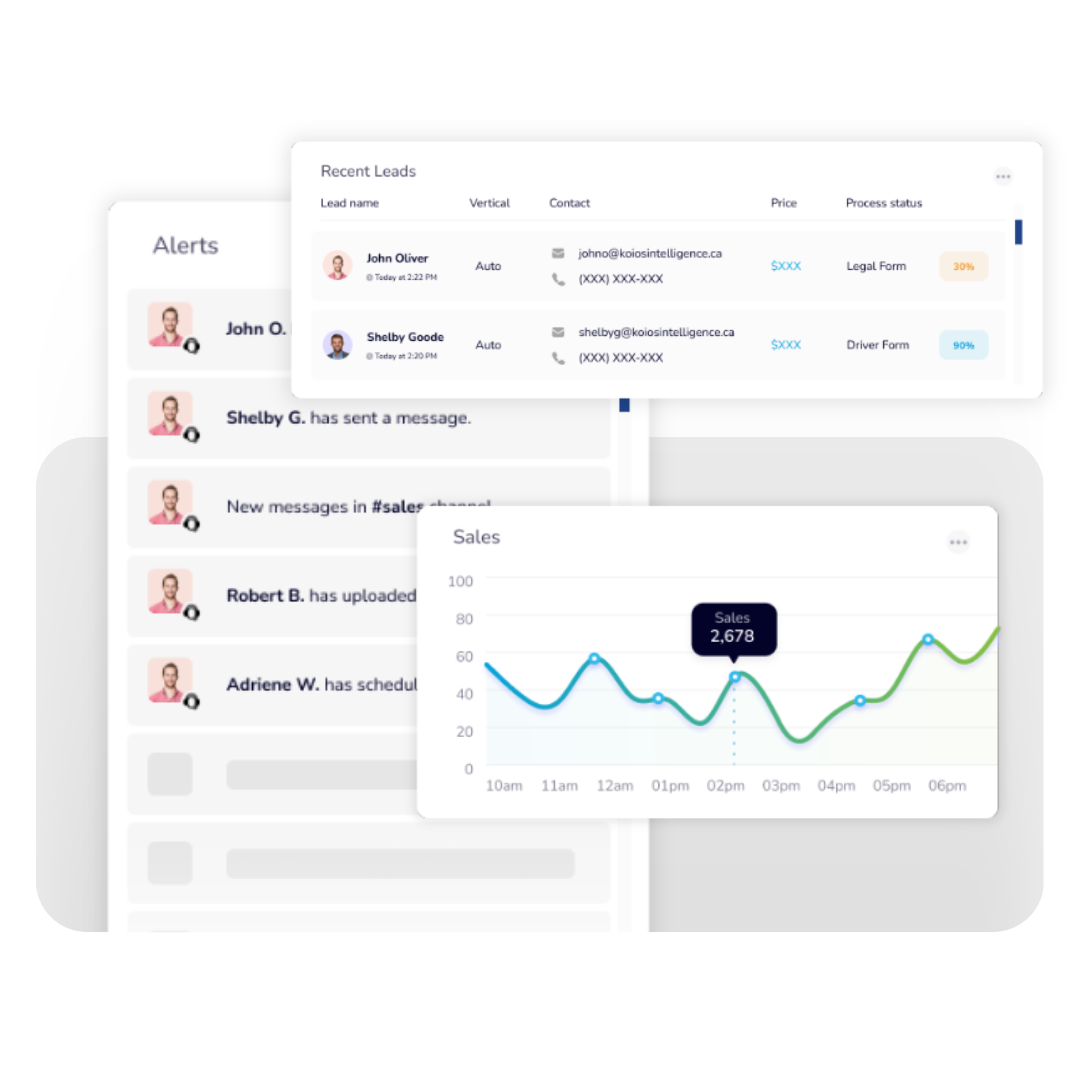

OlivoEngage

OlivoEngage

CRM System

Revolutionize data management with OlivoEngage — providing brokers and clients with a concise and customizable visualization of conversations. Every interaction with Olivo generates a record in OlivoEngage, empowering brokers to make real-time modifications for optimal data management.

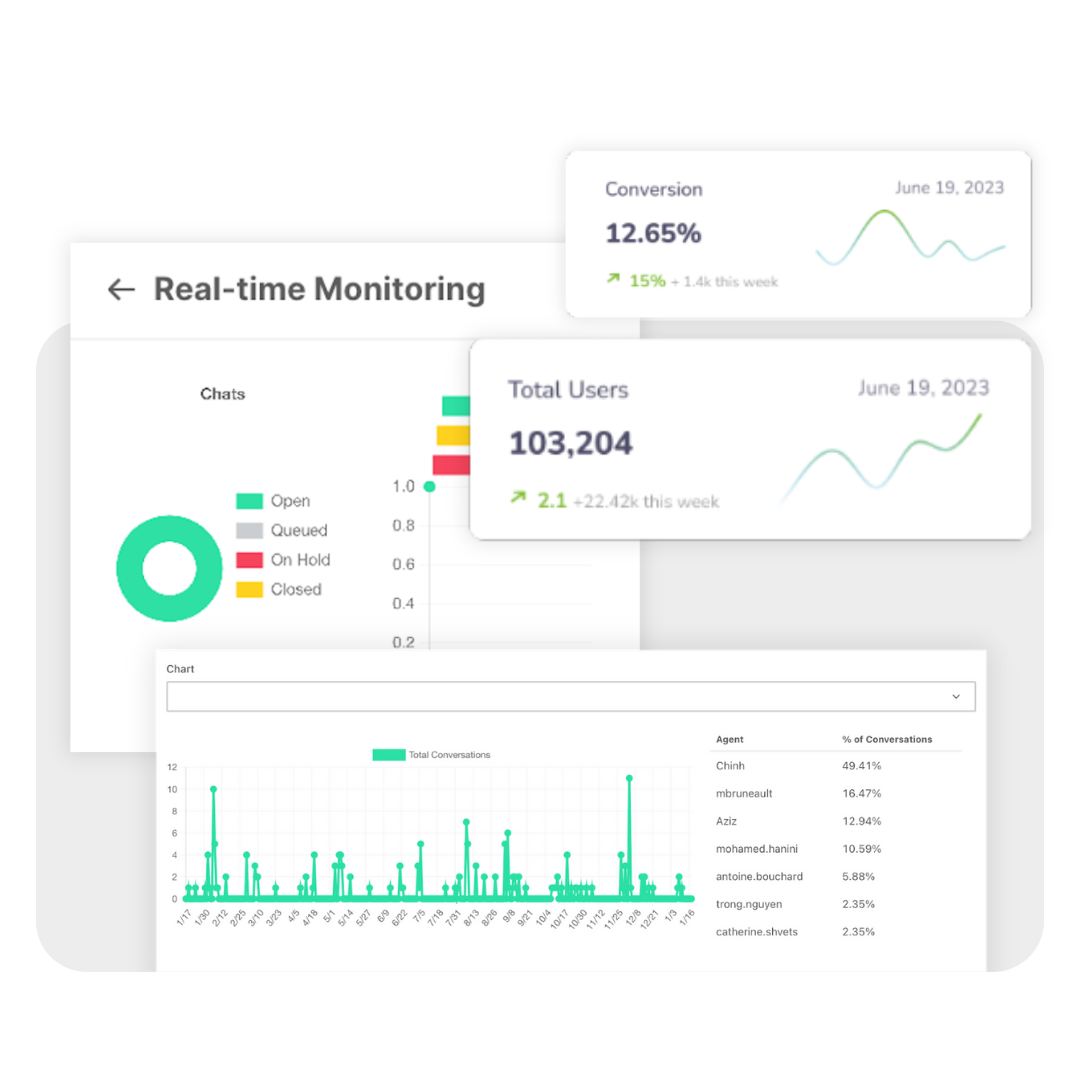

OlivoAnalytics

OlivoAnalytics

Data analytics tool

Empower your insurance agents and brokers with OlivoAnalytics — designed for real-time interaction monitoring. Dashboards expose leads and granular form entries, eliminating data entry hassles for enhanced efficiency. The analytics platform grants brokers valuable insights into conversations, providing a streamlined approach to lead management and data visualization.

Value chain

Product Management

Product Development

Actuarial Process

Risk Management

Product Pricing

Regulatory Reporting

Product Recommendation

Marketing

Lead Generation

Quote

Channel Support

Campaign

Upsell/Cross-Sell

Customer Advising

Underwriting & Acquisition

Document Submission

Underwriting

Fraud Management

Policy Issue

Payments

Policy Serving

Customer Queries

Policy Endorsements

Policy Renewals

Payment & Refunds

Agent Inquiries

Notifications & Updates

Claims Management

Claims FNOL

Claims Validation

Claims Assessment

Claims Adjudication

Claims Settlement

Subrogation & Recovery