Une application qui pourrait bouleverser le milieu de l’assurance

With its Olivo app, Koïos Intelligence intends to revolutionize a field that many consumers still don't fully understand.

Publié le 5 mai 2020

Alizée Calza

Alizée CalzaIl y a deux ans, David Stréliski, chef du Conseil et président du conseil d’administration de Koïos Intelligence

promised "a unique, easy-to-use tool accessible by all players in the insurance ecosystem, consumers, brokers and insurers alike" that would function like the "Airbnb of insurance".

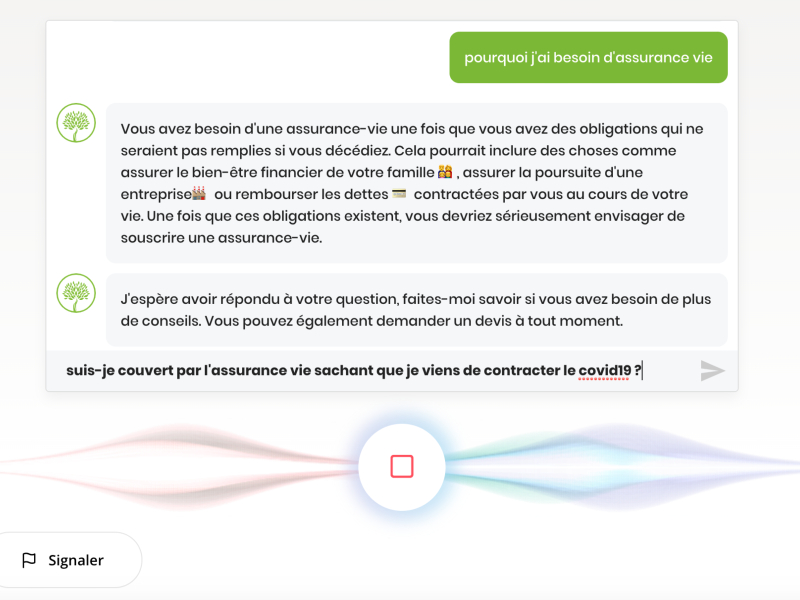

After a great deal of development work, Olivo is finally ready to be launched on the market, and may well turn the insurance industry upside down. This tool, based on artificial intelligence (AI) and automatic language processing, can answer customers' questions, manage their queries and, above all, connect them to insurers and brokers.

Avec cette application, Mohamed Hanini, PDG, fondateur et Chef scientifique de Koïos Intelligence, précise que le but n’est pas d’éliminer le courtier, mais bien d’accélérer son travail.

"We're a software publisher, not an insurer. We don't sell insurance, but we do offer insurers, insurance companies and brokerage firms an insurance platform that streamlines the underwriting process. We market a platform to brokers and major insurance companies, and it's up to them to convince consumers," he explains in an interview with Finance et Investissement..

Accélérer un long processus

Offering a life insurance product to a customer is a time-consuming process for a broker. You have to meet the customer, explain the products, establish a price, make a quote to the insurer – and there's no guarantee that the customer won't ultimately decide to decline the offer.

Olivo entre directement en relation avec le client qui peut discuter avec lui, lui poser ses questions et obtenir des réponses sans qu’un humain n’intervienne. Il peut finalement offrir une proposition au client en fonction de leur conversation et des informations fournies.

"The application is based on the average price and gives the quotation according to the value of the cover," describes Mohamed Hanini.

Si le programme permet d’éviter au conseiller de convaincre le client, il permet aussi d’accélérer la prise d’informations. Effectivement, le système de dialogue vient avec un tableau de bord pour l’assureur et le courtier qui réunit les informations et permet de voir les produits qui manquent au client ou ceux qui se recoupent.

"It's like a sorting system, in the end," comments Mohamed Hanini. There's a whole automatic input of data or information in real time. This speeds up the whole underwriting process for a broker or insurer."

En plus de l’assurance vie, Olivo fonctionne également pour l’assurance de dommage, l’assurance voyage et actuellement Koïos Intelligence se penche sur l’assurance maladie pour que celle-ci soit également disponible.

Un système qui mesure l’intention du consommateur

What's impressive about Olivo is that it really is a program that the consumer can talk to," says Mohamed Hanini. Currently, most dialogue systems on the market are guided. "They talk to us about AI, but clearly there are decision rules behind it."

Olivo, for its part, offers an open conversation. The consumer doesn't even need an interface to dialogue with a box, although of course he or she can also use chat. "We don't even need a computer, it could be indexed to insurance Alexa," adds the startup's CEO.

As the program measures the consumer's intent, it is able to understand what they mean despite any errors in diction or spelling.

"Natural language processing is based on similarity measurements, taking context into account," explains Mohamed Hanini. We propose a dynamic dialogue system that offers an unparalleled customer experience. What's really interesting is that, via a user-friendly conversation, you can fill in the form and get a quote.

"For us, the customer experience, and therefore the consumer, is at the center of the product. If we want to succeed with insurers, the customer really has to be seduced by the technology," he adds.

Une belle croissance en vue

Malgré la pandémie actuelle, Koïos Intelligence prévoit un futur brillant pour Olivo. Puisque leur produit est en ligne, la société n’a été que peu impactée par la pandémie et envisage même de nombreuses embauches en 2020.

Koïos Intelligence already has two customers, two firm signatures obtained in late 2019, early 2020. The first launch phase with them is scheduled for September. "It takes us 3-4 months to customize the app for customers, so it works according to their forms," explains Mohamed Hanini.

En plus de ces clients, la compagnie est en discussion avancée avec une dizaine de clients.

"When I say discussions, we were talking about integration and price. We're in like the sixth meeting, so it's pretty advanced," says Mohamed Hanini.

As a result of these developments, the startup, which has around twenty employees between Montreal and their structure in Tunisia, expects to make a number of new hires between now and the end of the year. "It will depend of course on the commercial phase, but we'll be able to reach 45-50 people by the end of the year in the best-case scenario. In the medium scenario, we'll be between 35-40."

Koïos Intelligence compte toutefois déjà une dizaine de postes à combler pour des scientifiques de données et des développeurs.

Finally, Koïos Intelligence is planning a major fund-raising round in the autumn. The startup believes the time is right to ask backers for help in expanding internationally, particularly in North America and especially the US market. "That's where there are the most insurers in the world, and where this kind of product could be revolutionary," comments the CEO.

La startup se tourne seulement maintenant vers les rondes de financement, car ses fondateurs refusaient de demander des fonds en proposant seulement une idée.

"Some startups evolve in a speculative way. We wanted to develop a great product, get sales and then raise funds organically. In my opinion, that's how a company takes root," he concludes.

Abonnez-vous à notre newsletter gratuite.

À propos de Koïos Intelligence

Fondée en 2017, Koïos Intelligence a pour mission de doter le secteur de l'assurance et de la finance de systèmes intelligents et personnalisés de nouvelle génération, s'appuyant sur l'intelligence artificielle, les statistiques et la recherche opérationnelle. En combinant les connaissances de nos experts de premier plan en assurance, finance et intelligence artificielle, Koïos développe de nouvelles technologies qui redéfinissent les interactions entre les assureurs, les courtiers et les clients.